他点赞了

他点赞了

他点赞了

他点赞了

他点赞了

- yekta_marketfuel :my dear friend I can guide you through the process when you will be making up to $10,000 as profit in just 72 hours

他点赞了

他点赞了

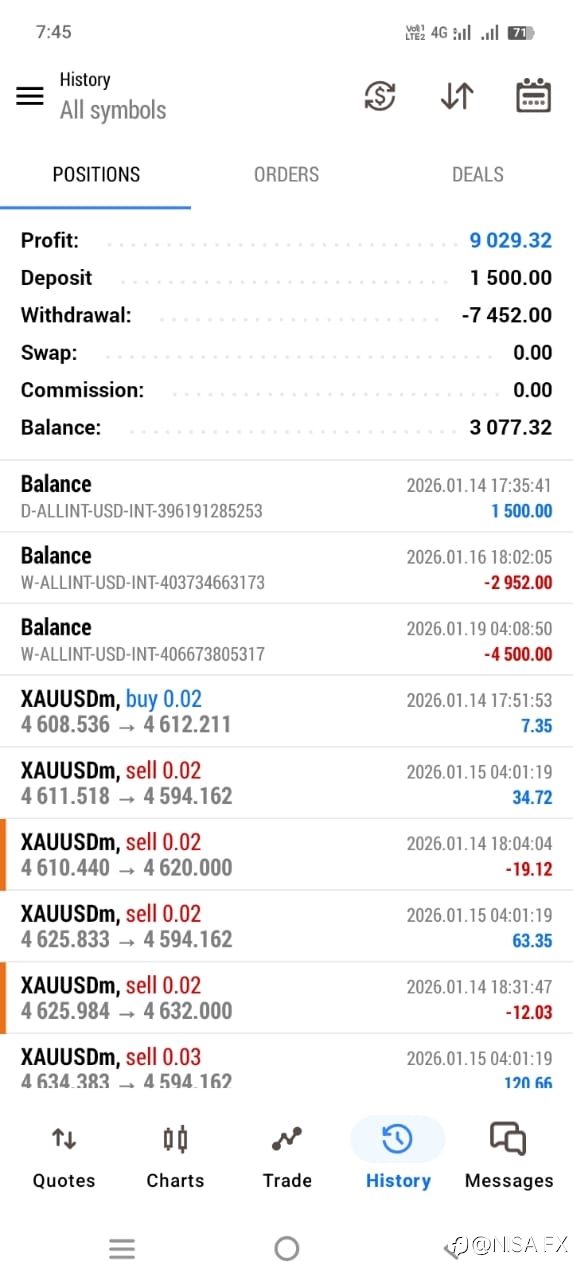

跟随收益

211.29

USD

- 品种 XAU/USD

- 交易账户 #1 8081309

- 交易商 Windsor Brokers

- 开/平仓价格 4,411/4,445.54

- 交易量 买入 0.06 Flots

- 收益 207.24 USD

他点赞了

- Chloe_Jeck :*Gold Update | XAUUSD* As per yesterday’s analysis, Gold continued its bullish move, successfully breaking *4450* and printing a high at *4497.6* — just *25 pips* away from the *4500* psychological...

他点赞了

他点赞了

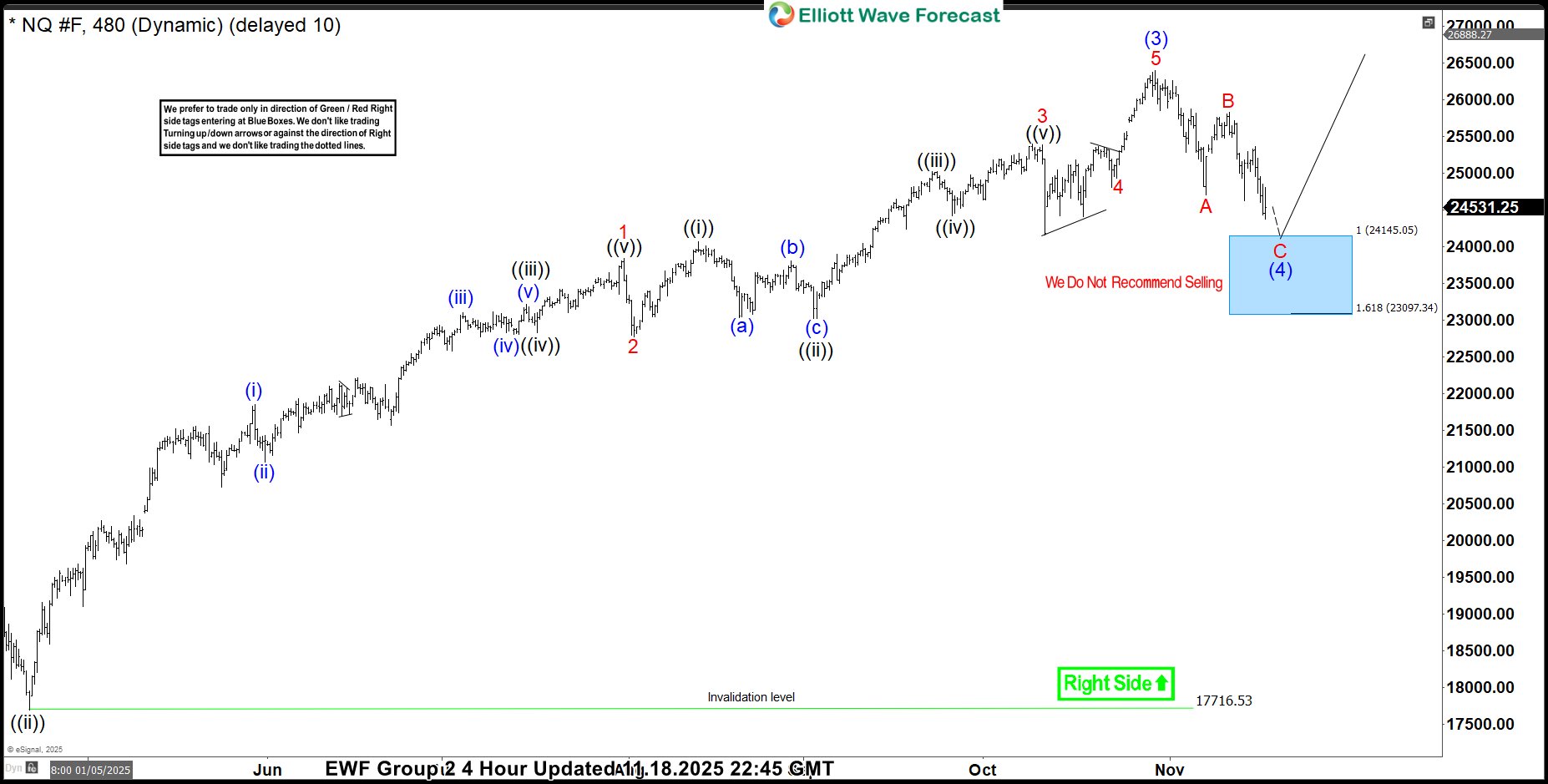

NASDAQ (NQ_F) Elliott Wave: Buying the Dips in a Blue Box

Hello traders. As our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in E-mini Nasdaq-100 Futures. Recently NQ_F made a clear three-wave correction. The pull back comple

他点赞了

Why Global Markets Are Closely Watching the Japanese Yen

The Japanese yen has become one of the most closely monitored currencies in global markets, especially as economic conditions shift and central-bank expectations evolve. Investors are paying attention because the yen often behaves as a measure of broader risk sentiment. When uncertainty rises across

他点赞了

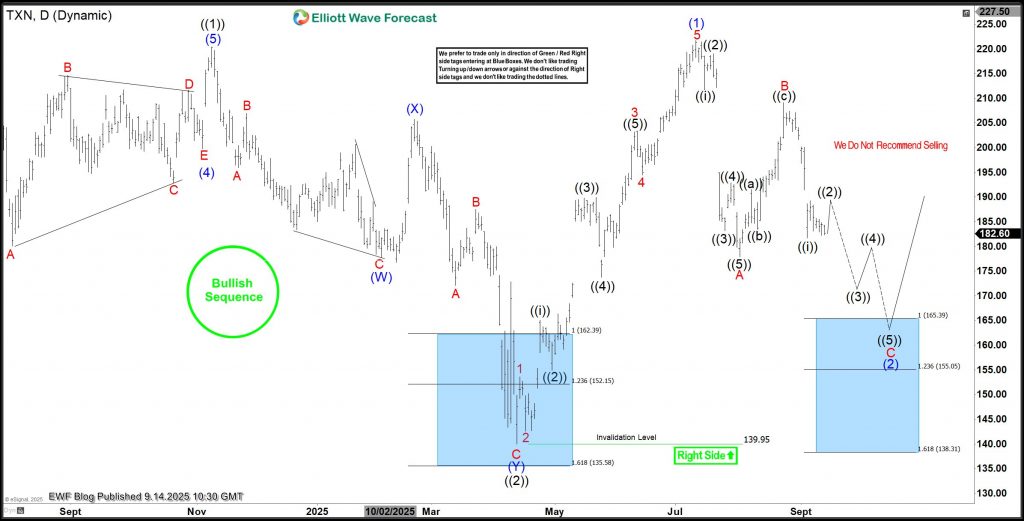

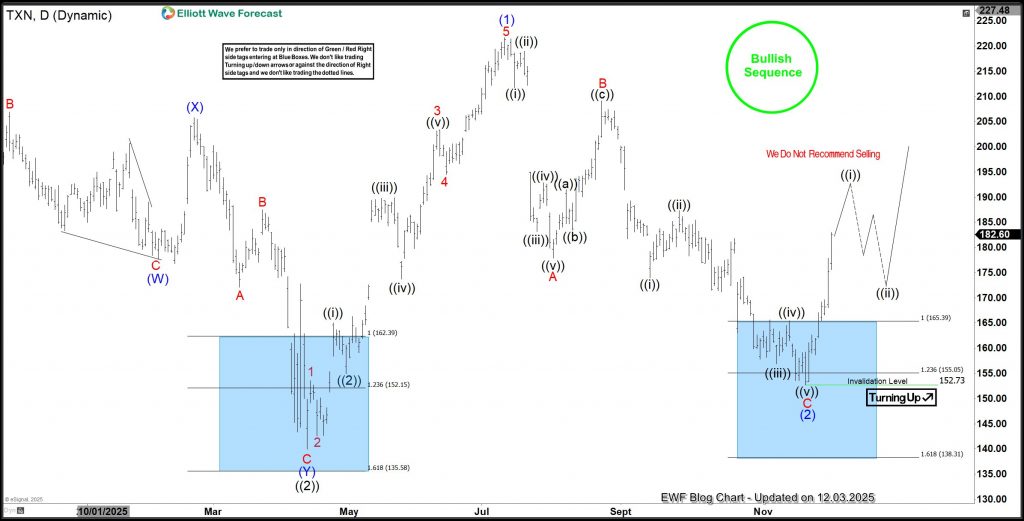

TXN Rebounds Strongly from Blue Box, Wave (3) Targets $285

TXN completed a zigzag correction from the July 2025 high, finishing right inside the blue-box support area where new buying interest emerged. The stock has since launched into a strong rally from that zone, putting buyers solidly in profit. Texas Instruments (TXN) is a global semiconductor com

他点赞了

What This Means for Korea’s Economy and Financial Markets

The Bank of Korea’s decision to signal a pause has meaningful implications across the economy. For consumers, borrowing costs may stay unchanged for a while, which affects decisions such as home purchases, personal loans, and business expansion plans. For markets, the message contributes to a

他点赞了

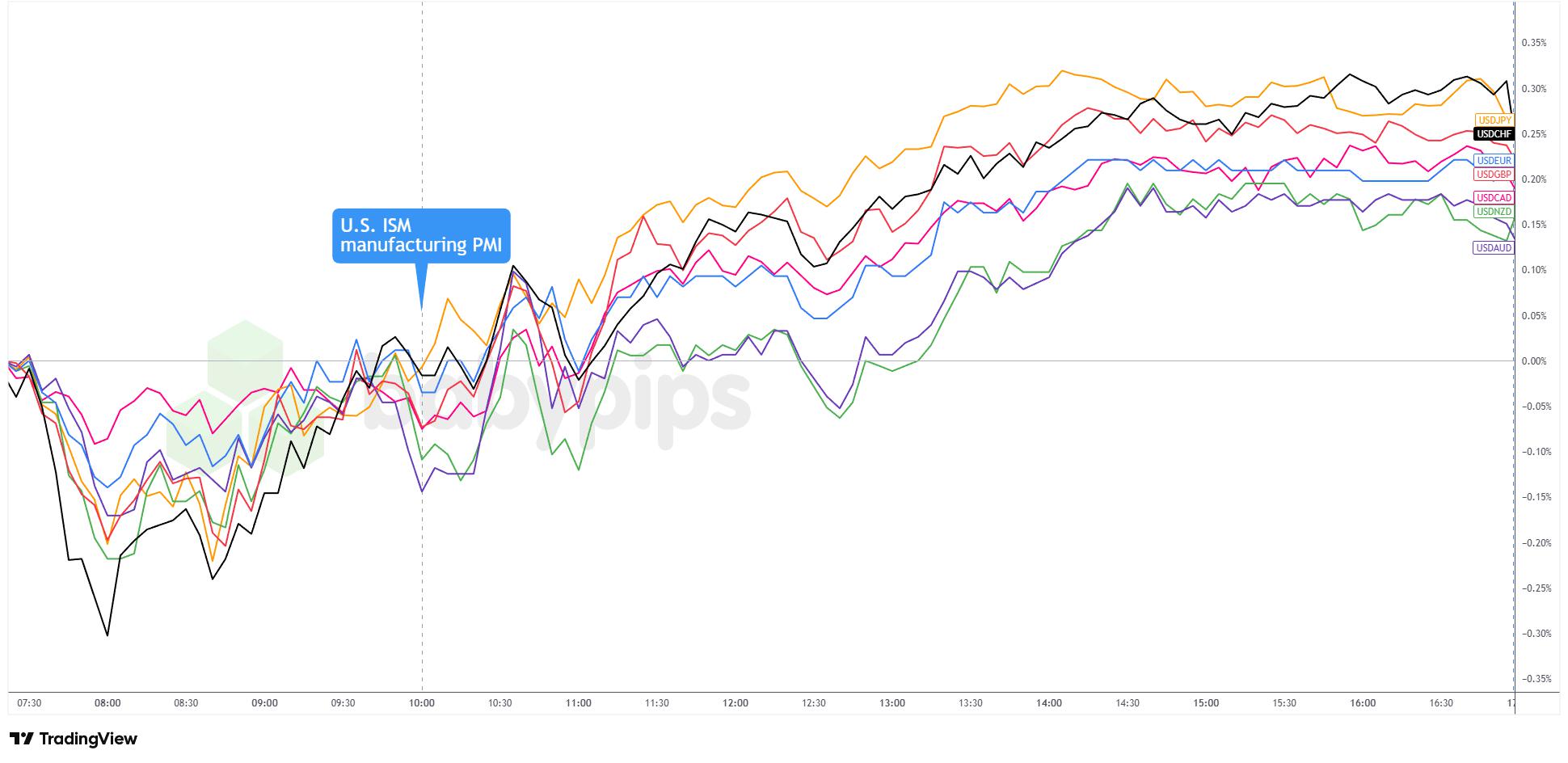

U.S. Dollar Holds Firm as November Marks 9th Straight ISM Manufacturing Decline

Partner Center The ISM manufacturing PMI for November slipped to 48.2 from 48.7 in October, missing the 49.0 consensus to reflect the ninth consecutive month of manufacturing contraction. The deterioration came despite a production rebound, as new orders weakened and tariff-related uncertainty conti

正在加载中...